Following the announcement of a new ‘super-deduction’ tax scheme for companies looking to invest in new machinery, there has never been a better time to invest in automation equipment. The UK Government’s recent initiative, effective 1 April 2021, aims to incentivise companies to invest in new plant and machinery within the next two years. It is seen as an encouraging step forward in re-building UK manufacturing in the aftermath of the Covid-19 pandemic.

What is the super-deduction tax scheme?

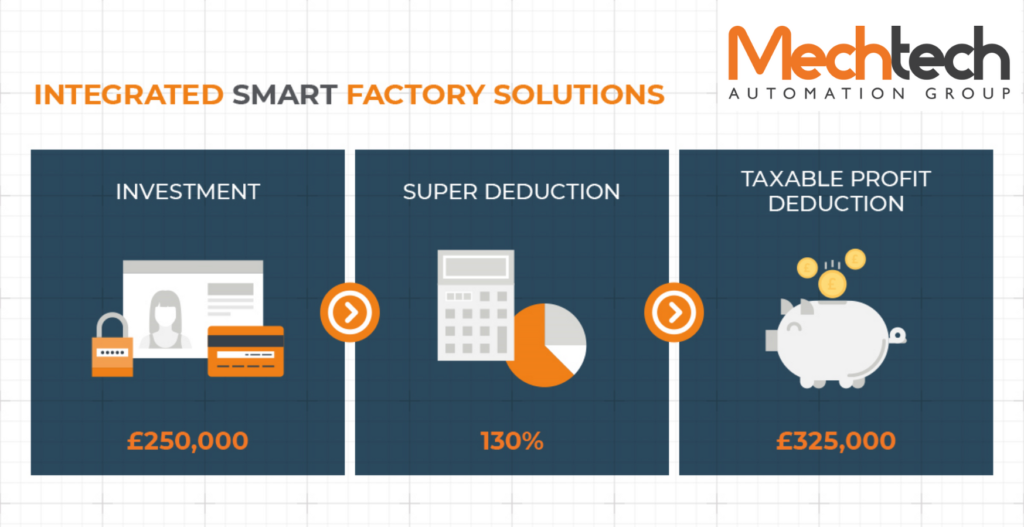

Effective from 1 from April 2021 to 31 March 2023, eligible companies can claim a 130% capital allowance on qualifying plant and machinery investments, as well as a 50% year one allowance on special rate assets. Under the super-deduction scheme, this would mean that companies can reduce their tax bill by up to 25p for every £1 invested.

How could this benefit your company? A huge incentive to invest.

The super-deduction tax reduction could provide huge tax savings for companies planning to invest and provides a strong incentive to make additional investments. It also encourages UK businesses to bring forward any future planned investment so that is happens in the next two years.

What’s included in the scheme?

Most tangible capital assets used in the course of a business are considered plant and machinery for the purposes of claiming capital allowances. The purchase of new equipment from Mechtech Automation Group could qualify* for the new ‘super deduction’ for corporation tax relief.

How Mechtech Automation Group can help you?

Mechtech Automation Group, incorporating Mechatronic, Robopod and MAGserv delivers integrated smart factory solutions to a range of industry sectors through innovation, engineering excellence and first-class customer service. Get in touch with us today if you are planning to invest in a new automated solution or need advice on how to re-configure existing equipment. With over 30 years’ engineering experience, as well as delivering full turnkey solutions, we specialise in re-tooling and re-configuring so our clients constantly maximise their return on investment. Our engineering team can assist you at all stages of the process from conception through to design, manufacture and installation.

For more information visit us here.

For full information and to access the UK Government fact sheet, click here.

* The particular circumstances of the purchaser, for example nature of business, method of finance, etc. would have a bearing on whether or not the expenditure will meet the detailed rules to qualify. Hence, you should take specialist tax advice on your circumstances to ensure you meet the qualification requirements.

Recent Comments